It has been a while since I posted up a FTOD. This one rehashes the power of compound interest, but in a slightly different light.

One of my financial goals is to "leave a legacy" for my children, grandchildren and future generations. There are a number of tools and financial instruments in which to do this, but this tip simply focuses on the math side of it.

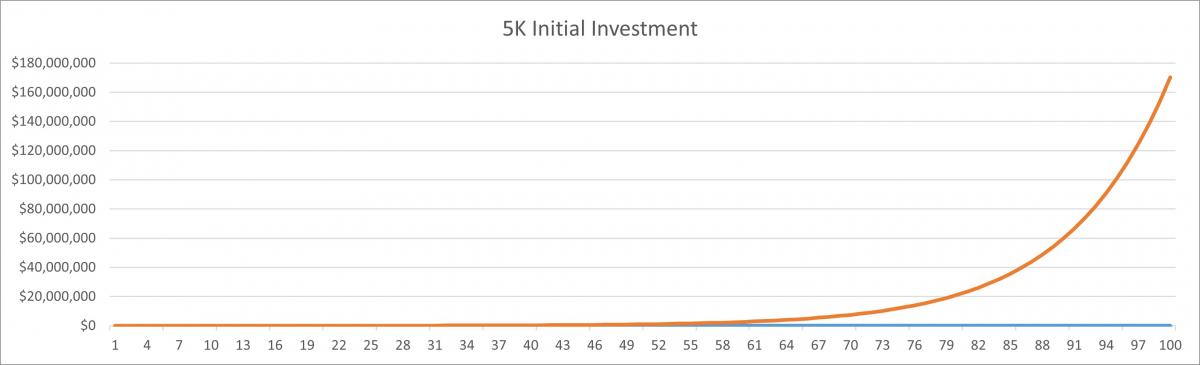

I am thinking about what I could do to establish generational wealth, literally forever. Dream big!!!!!! What if I invested $5k and forgot about it for the next 100 yrs?

So, I put together some simple future value calculations over a 100 yr period (3-4 generations) just to see where certain numbers could end up in the future.

DISCLAIMER: I am making several reasonable assumptions concerning taxes, rates of return, reinvestments and hoping one generation doesn't destroy my legacy.....

I used an 11% rate of return (S&P 500 ROR over the last 100 yrs) and assumed no material taxable events during investment.

Yep..... $5K turned into $170 Million over 100 yrs.

What if you invested $10K?

$50K?

100K?

That is $3.4 Billion over a 100 yrs. Sure, lots can change and happen along with inflation and market collapse, but that would be one heck of a legacy!!!!!

If nothing else, it forces us to see to impacts of time value of money coupled with compounding interest over extended periods of time.

One of my financial goals is to "leave a legacy" for my children, grandchildren and future generations. There are a number of tools and financial instruments in which to do this, but this tip simply focuses on the math side of it.

I am thinking about what I could do to establish generational wealth, literally forever. Dream big!!!!!! What if I invested $5k and forgot about it for the next 100 yrs?

So, I put together some simple future value calculations over a 100 yr period (3-4 generations) just to see where certain numbers could end up in the future.

DISCLAIMER: I am making several reasonable assumptions concerning taxes, rates of return, reinvestments and hoping one generation doesn't destroy my legacy.....

I used an 11% rate of return (S&P 500 ROR over the last 100 yrs) and assumed no material taxable events during investment.

Yep..... $5K turned into $170 Million over 100 yrs.

What if you invested $10K?

$50K?

100K?

That is $3.4 Billion over a 100 yrs. Sure, lots can change and happen along with inflation and market collapse, but that would be one heck of a legacy!!!!!

If nothing else, it forces us to see to impacts of time value of money coupled with compounding interest over extended periods of time.

Comment